Quarter-Point Mortgage Rate Hike Knocks 1.3 Million Households Out of Market

In today’s interest rate environment, a quarter-point rise in mortgage rates would price approximately 1.3 million households out of the market for a new home with an estimated median price of $425,786, according to the latest analysis by NAHB. And if the Federal Reserve moves later today to continue to hike interest rates, this will put upward pressure on mortgage rates.

Monthly mortgage payments would increase as a result of rising mortgage interest rates, and therefore, higher household income thresholds would be needed to qualify for a mortgage. In other words, a quarter-point rate hike would force potential buyers to set their sights on a house selling lower than a median-priced home.

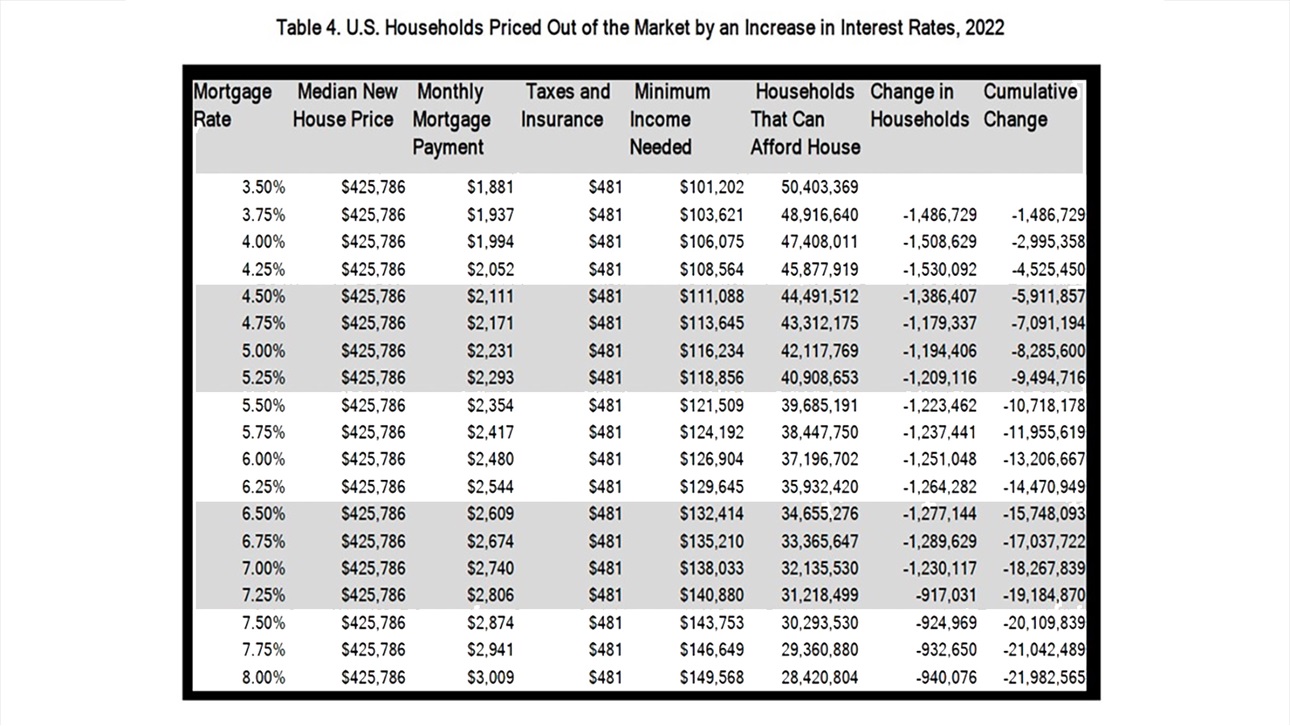

The table below shows the number of households priced out of the market for a new median-priced home at $425,786 for each 25 basis-point increase in interest rates from 3.5% to 8%. When interest rates increase from 6.25% to 6.5%, approximately 1.28 million households can no longer afford to buy a median-priced new home. An increase from 6.5% to 7% prices approximately 1.29 million more households out of the market.

As interest rates rise higher, fewer households are priced out of the market for a median-priced home because only a declining number of households at the higher end of household income distribution would be affected. When interest rates are relatively low, a 25 basis-point increase would affect a larger number of households at the lower and more populous part of income distribution.

Another recent report from NAHB shows how many households in individual states and metro areas would be priced out of a home for each $1,000 increase in the price of a home.

NAHB Principal Economist Na Zhao provided this analysis in a recent Eye on Housing blog post.

Latest from NAHBNow

Mar 03, 2026

Delaware Home Builders Score Permitting VictoryMembers sustained advocacy efforts helped shape an executive order designed to fast-track development and improve housing affordability in the state.

Mar 02, 2026

Top 10 States for NGBS Green Certification Activity in 2025Texas once again tops multifamily certification, and Florida took the top spot for most single-family certifications for the second consecutive year.

Latest Economic News

Feb 27, 2026

Gains for Student Housing Construction in the Last Quarter of 2025Private fixed investment for student dormitories was up 1.5% in the last quarter of 2025, reaching a seasonally adjusted annual rate (SAAR) of $3.9 billion. This gain followed three consecutive quarterly declines before rebounding in the final two quarters of the year.

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.