Share of Homes Built on Slabs Surges

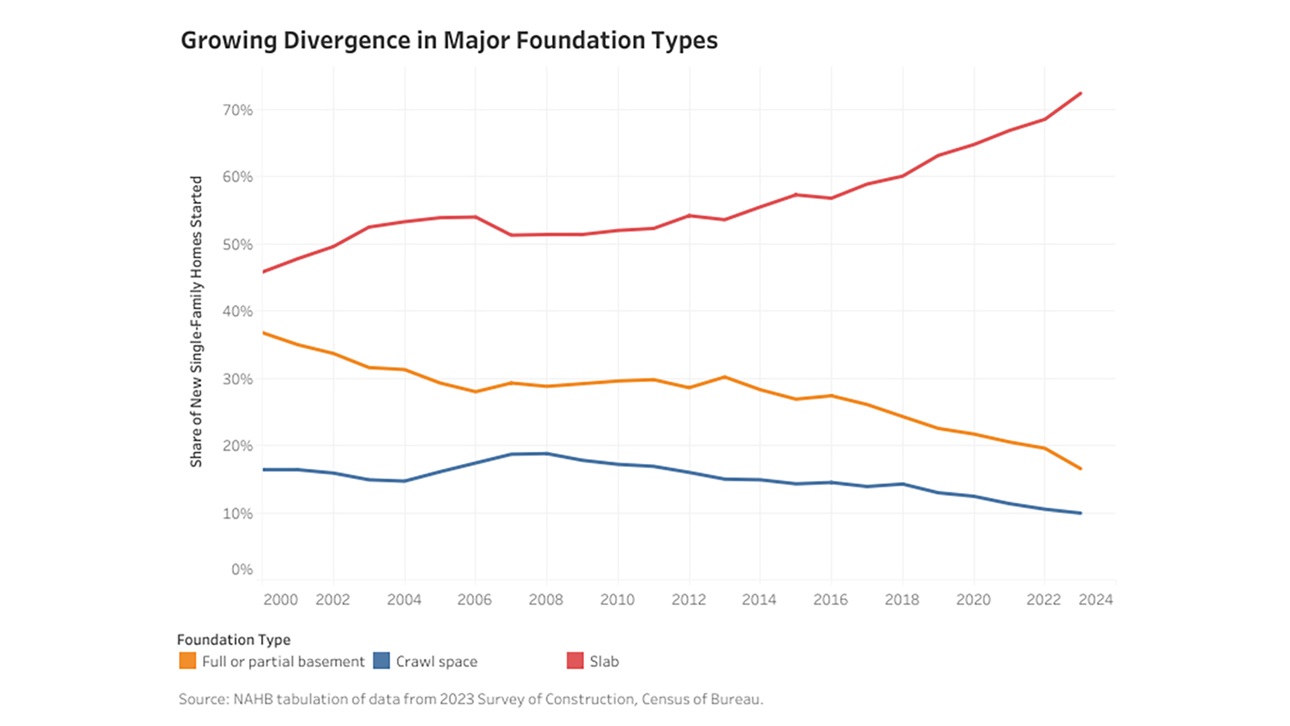

The majority of new single-family homes started in 2023 were built on slab foundations, according to NAHB analysis of the Survey of Construction (SOC). The share of new homes built on slabs has risen steadily from 45.8% in 2000 to 72.4% in 2023. The largest increase occurred from 2022 to 2023, with a jump of 3.9 percentage points, compared to an average increase of 1.93 percentage points over the previous five years.

Conversely, the share of homes with full or partial basements decreased by 3 percentage points from 19.6% in 2022 to 16.6% 2023. Only 9.9% of new single-family homes were built with crawl spaces.

In colder areas where building codes require foundations to be built below the frost line, most homes are constructed with full or partial basements. In the northern divisions, full or partial basement foundations provide additional finished floor areas at a marginal increase of construction cost. The divisions with a majority share of full or partial basements in new homes are West North Central (63.9%), followed by New England (62.1%), Middle Atlantic (48.1%) and East North Central (48%).

In warmer climates where slab foundations are preferred for their cost-effectiveness, new homes with slab foundations are most commonly found in the West South Central (96.9%), Pacific (86.5%), South Atlantic (83.3%) and Mountain (52.9%) divisions.

NAHB Economist Catherine Koh provides more, including interactive graphics, in this Eye on Housing post.

Latest from NAHBNow

Mar 06, 2026

NAHB Commends Court Ruling Vacating HUD 2021 IECC MandateNAHB Chairman Bill Owens issued the following statement after the Eastern District Court of Texas issued its decision in a lawsuit brought by NAHB and 15 states challenging the legality of the HUD and USDA rule imposing the 2021 International Energy Conservation Code and the 2019 ASHRAE 90.1 standard on certain housing programs.

Mar 06, 2026

Bill Truex Seeks Certification as a Candidate for 2028 NAHB Third Vice ChairmanThe NAHB Nominations Committee announces that Bill Truex, president, Truex Preferred Construction in Englewood, FL, has submitted his Letter of Intent to seek certification as a candidate for NAHB 2028 Third Vice Chairman.

Latest Economic News

Mar 06, 2026

U.S. Economy Loses 92,000 Jobs in FebruaryThe U.S. labor market weakened in February, as payroll employment declined and the unemployment rate rose to 4.4%. The cooling labor market could place the Federal Reserve in a challenging position as policymakers weigh slower job growth against inflation pressures from rising oil prices.

Mar 05, 2026

Builders Identify Key Long-Term Forces Shaping Housing Demand and Industry HealthHome builders are keenly aware of the complex long-term outlook ahead for the home building industry. A recent NAHB/Wells Fargo HMI survey asked builders to assess the impact of 14 major trends and forces on the health of the industry and housing demand over the next 10 years.

Mar 05, 2026

Affordability Posts Mild Gains in Second Half of 2025 but Crisis ContinuesThough new and existing homes remain largely unaffordable, the needle moved slightly in the right direction in the second half of 2025, according to the latest data from the National Association of Home Builders (NAHB)/Wells Fargo Cost of Housing Index (CHI).