Home Price Gains Continue to Slow

Home price growth continues to decelerate, according to the recent release of the S&P CoreLogic Case-Shiller Home Price Index (HPI). The S&P CoreLogic Case-Shiller HPI increased at a seasonally adjusted annual rate of 1.89% for June 2024, slowing from a revised rate of 3.28% in May.

Home prices have not seen an outright decrease since January 2023. However, 1.89% is the smallest growth in prices since February 2023. Additionally, the growth rate has shown a generally declining trend since a peak of 9.76% in August 2023.

Meanwhile, the Home Price Index released by the Federal Housing Finance Agency (FHFA) recorded a decline in home prices for June. The index declined at a seasonally adjusted annual rate of -1.04% for June, decreasing from a revised 0.51% rate in May. The FHFA Index has experienced just one other decrease since August 2022 — a decline of -1.03% in January 2024.

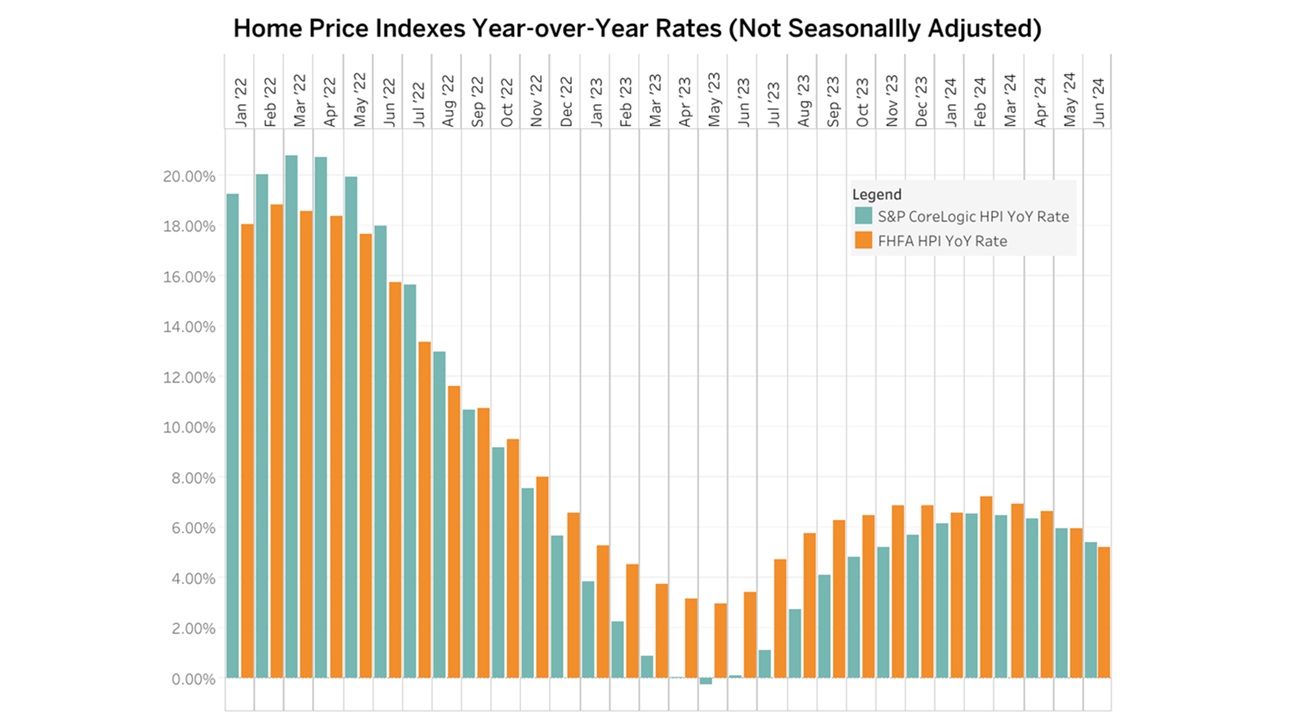

Home prices experienced a fourth year-over-year deceleration in June, tabulated by both indexes. The S&P CoreLogic Case-Shiller HPI (not seasonally adjusted – NSA) posted a 5.42% annual gain in June, down from a 5.94% increase in May.

Since June 2023, the index has seen steady increases in the year-over-year growth rate. However, this growth rate began slowing in March 2024 and has continued to decelerate through June. Meanwhile, the FHFA HPI (NSA) index rose 5.23%, down from 5.95% in May. This rate has decelerated from 7.19% in February.

See how prices changed across 20 metro areas and the nine Census divisions in this Eye on Housing post.

Latest from NAHBNow

Mar 10, 2026

NAHB Announces 7 Fall Recruitment Competition WinnersFor their efforts, top Builder winners earned LG laundry machines, and Associate winners and all runners-up earned International Builders’ Show (IBS) VIP ticket packages, including registration to the show, IBS House Party tickets, opening ceremony seat reservations and VIP Closing Concert tickets.

Mar 09, 2026

Laura Dwyer Wins SA Walters Lifetime Achievement Award for Systems Built HousingThe NAHB Building Systems Councils has awarded the S.A. Walters Award for Lifetime Achievement in Systems Built Housing to Laura Dwyer, recognizing her decades of leadership, innovation, and service to the homebuilding industry.

Latest Economic News

Mar 10, 2026

AD&C Loan Volume Falls Despite Declining Financing CostsSingle-family construction lending fell in the fourth quarter, according to data released by the Federal Deposit Insurance Corporation (FDIC).

Mar 09, 2026

Lower Mortgage Rates Boost Refinancing While Purchase Activity SlowsMortgage application activity increased month-over-month as the 30-year fixed mortgage rates reached a three-year low.

Mar 06, 2026

U.S. Economy Loses 92,000 Jobs in FebruaryThe U.S. labor market weakened in February, as payroll employment declined and the unemployment rate rose to 4.4%. The cooling labor market could place the Federal Reserve in a challenging position as policymakers weigh slower job growth against inflation pressures from rising oil prices.