Existing Home Sales Edge Higher in July

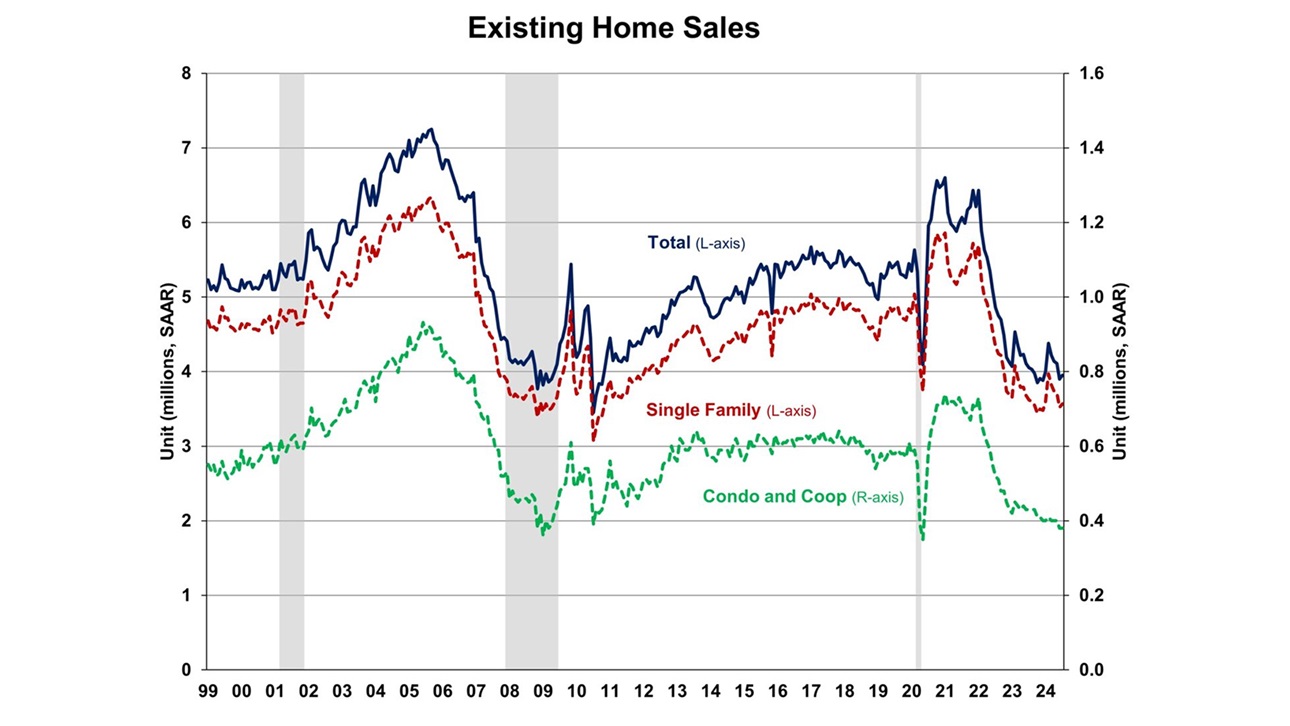

Existing home sales increased for the first time in five months, according to the National Association of Realtors, as improving inventory and declining mortgage rates motivated more prospective buyers to act.

Despite these changes, sales remained sluggish and low inventory continued to push up median home prices. However, NAHB expects increased activity in the coming months as mortgage rates continue to moderate. Improving inventory is likely to ease home price growth and enhance housing affordability.

Home owners with lower mortgage rates have opted to stay put, avoiding trading existing mortgages for new ones with higher rates. This "lock-in" trend is driving home prices higher and holding back inventory. Mortgage rates are expected to continue to decrease gradually, leading to increased demand (and unlocking more of the lock-in inventory) in the coming quarters.

Total existing home sales rose 1.3% to a seasonally adjusted annual rate of 3.95 million in July. This marks the first increase after four months of declines. On a year-over-year basis, sales were still 2.5% lower than a year ago.

At the current sales rate, July unsold inventory sits at a 4.0-month supply (down from 4.1 last month, but up from 3.3 a year ago). This inventory level remains low compared to balanced market conditions (a 4.5- to 6-month supply) and illustrates the long-run need for more home construction.

The July median sales price of all existing homes was $422,600, up 4.2% from last year. This marked the 13th consecutive month of year-over-year increases. The median condominium/co-op price in July was up 2.7% from a year ago at $367,500. This rate of price growth will slow as inventory increases.

NAHB Senior Economist Fan-Yu Kuo provides more details, including regional and demographic breakdowns, in this Eye on Housing post.

Latest from NAHBNow

Mar 11, 2026

Emerging Leader Grant Opens the Door to National Leadership for More MembersIs a member leader at your HBA planning to attend their first NAHB leadership meeting this spring? Encourage them to apply for the NAHB Emerging Leader Grant. Applications are due April 20.

Mar 11, 2026

Podcast: Massive Win in Battle Over Federal Energy Code MandatesOn the latest episode of NAHB’s podcast, Housing Developments, CEO Jim Tobin and COO Paul Lopez welcome VP of Legal Advocacy Tom Ward to discuss the impact of the recent court decision on the Department of Housing and Urban Development’s (HUD) and the Department of Agriculture’s (USDA) final determination to impose the 2021 International Energy Conservation Code (IECC) and the 2019 ASHRAE 90.1 standard on certain single-family and multifamily housing programs.

Latest Economic News

Mar 11, 2026

Inflation Steady Before WarAfter months of downward trend, inflation held steady at an eight-month low in February. This report does not reflect the recent surge in oil prices due to Iran conflict beginning February 28. Higher oil prices will likely translate into higher gasoline costs and impact other sectors associated with transportation including airline tickets.

Mar 11, 2026

Single-Family Permits End 2025 on a Soft NoteSingle-family permitting softened over the course of 2025 and finished the year weaker than the prior year. After showing some resilience in 2024, permitting activity gradually lost momentum as elevated mortgage rates and ongoing affordability constraints weighed on buyer demand.

Mar 10, 2026

Existing Home Sales Rose in FebruaryFollowing the sharp decline last month, existing home sales bounced back in February as housing affordability improved. Lower mortgage rates and moderating home price growth helped pull buyers back to the market. However, tight inventory will likely continue to push home prices higher if demand outpaces supply growth.