Tightened Credit for Builders in Q2

During the second quarter of 2024, credit for residential Land Acquisition, Development & Construction (AD&C) continued to tighten and became even more expensive for most types of loans, according to NAHB’s survey on AD&C Financing. The survey was conducted in July and asked specifically about financing conditions in the second quarter, predating the release of some relatively weak economic data that has raised prospects for monetary policy easing.

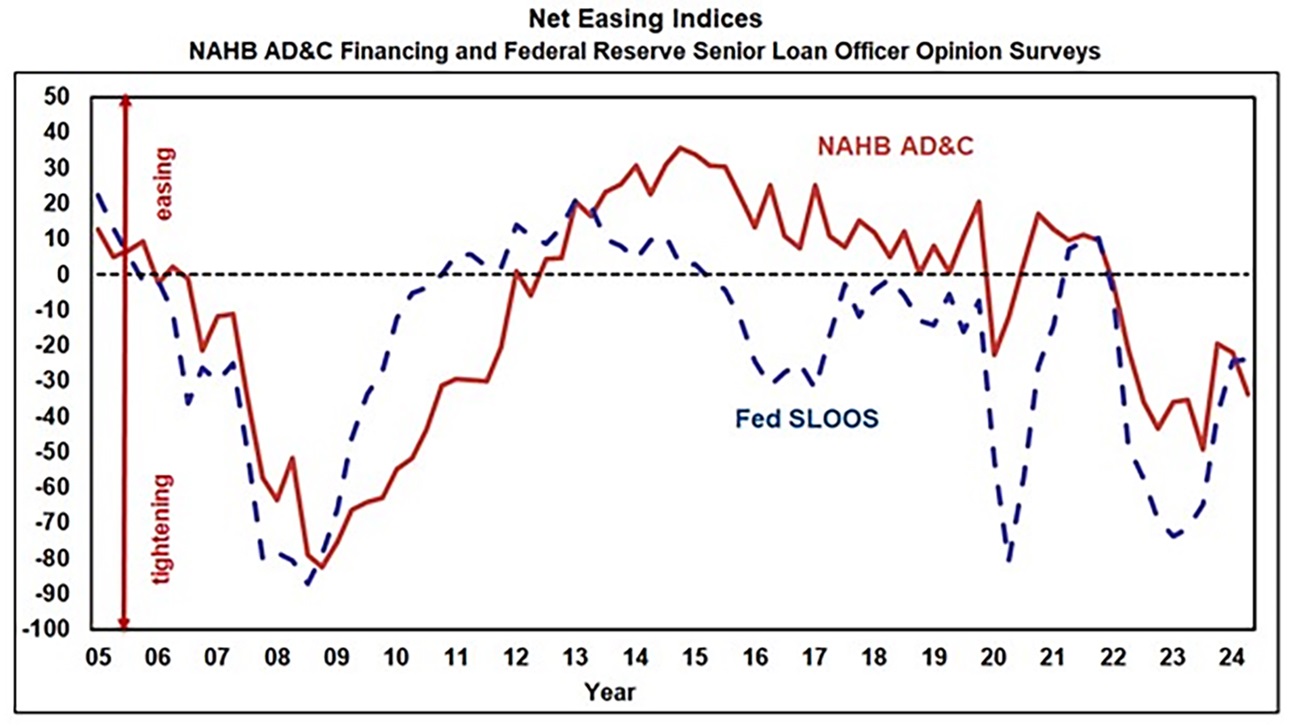

The net easing index derived from the survey posted a reading of -33.7 in the second quarter. (The negative number indicates that credit was tighter than in the previous quarter.) The comparable net easing index based on the Federal Reserve’s survey of senior loan officers posted a similar result, with a reading of -23.8 — marking the 10th consecutive quarter of borrowers and lenders both reporting tightening credit conditions.

According to the NAHB survey, the majority (85%) of respondents noted that lenders were tightening in the second quarter by:

- Reducing the amount they are willing to lend, and

- Lowering the loan-to-value (or loan-to-cost) ratio.

Half of respondents also reported tightening by increasing documentation, increasing the interest rate, and requiring personal guarantees or other collateral unrelated to the project.

As credit becomes less available, it also tends to become more expensive. In the second quarter, the contract interest rate increased on all four categories of AD&C loans tracked in the NAHB survey:

- 8.40% in 2024 Q1 to 9.28% on loans for land acquisition,

- 8.07% to 9.05% on loans for land development,

- 8.24% to 8.98% on loans for speculative single-family construction, and

- 8.38% to 8.55% on loans for pre-sold single-family construction.

Paul Emrath, NAHB vice president for survey and housing policy, provides further insights in this Eye on Housing post.

Latest from NAHBNow

Mar 12, 2026

Statement from NAHB Chairman Bill Owens on Passage of Senate Housing BillNAHB Chairman Bill Owens issued the following statement after the Senate passed the 21st Century ROAD to Housing Act.

Mar 12, 2026

Single-Family Starts Remain Soft in January on Affordability ConcernsOverall housing starts increased 7.2% in January to a seasonally adjusted annual rate of 1.49 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

Latest Economic News

Mar 12, 2026

Single-Family Starts Remain Soft in January on Affordability ConcernsElevated construction costs and constrained affordability conditions led to a reduction in single-family housing starts in January.

Mar 11, 2026

Inflation Steady Before WarAfter months of downward trend, inflation held steady at an eight-month low in February. This report does not reflect the recent surge in oil prices due to Iran conflict beginning February 28. Higher oil prices will likely translate into higher gasoline costs and impact other sectors associated with transportation including airline tickets.

Mar 11, 2026

Single-Family Permits End 2025 on a Soft NoteSingle-family permitting softened over the course of 2025 and finished the year weaker than the prior year. After showing some resilience in 2024, permitting activity gradually lost momentum as elevated mortgage rates and ongoing affordability constraints weighed on buyer demand.