What to Know About the New Federal Flood Risk Management System

The Department of Housing and Urban Development released a new Federal Flood Risk Management Standard (FFRMS) in April 2024 that will affect both single-family homes and multifamily properties. Compliance will be required as of Jan. 1, 2025.

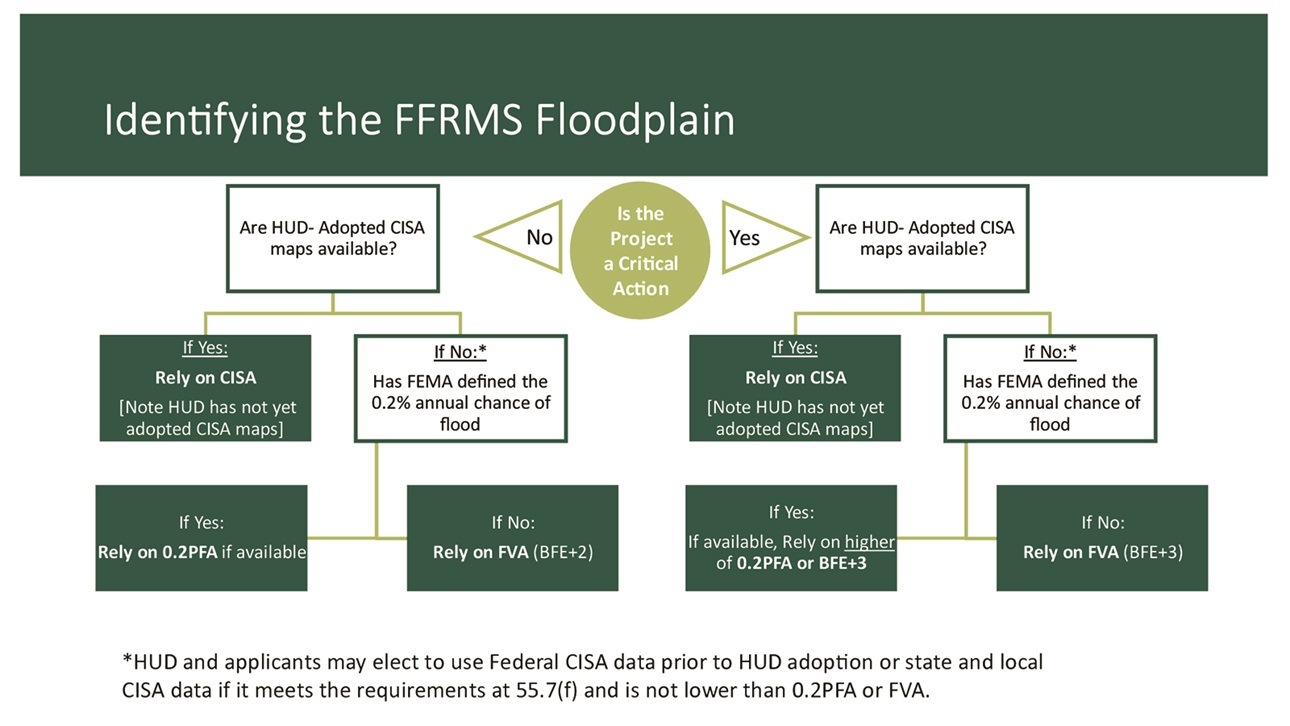

For FHA-insured or HUD-assisted multifamily properties, the new FFRMS requires a complicated, three-tiered process for determining the extent of the FFRMS floodplain, with a preference for a climate-informed science approach (CISA). The FFRMS expands the vertical and horizontal floodplain boundaries beyond the special flood hazard area (100-year floodplains). The rule requires more stringent elevation and flood proofing requirements of properties where federal funds are used to develop or provide financing for new construction within the now defined FFRMS floodplain. It also applies to substantial improvement to structures financed through HUD grants, subsidy programs and applicable multifamily programs.

Key points of interest for single-family builders and developers:

- Compliance with new elevation requirements will be required for single-family new construction where building permit applications are submitted on or after Jan. 1, 2025.

- HUD will require single-family homes located in a 100-year floodplain to be elevated 2 feet above base flood elevation to qualify for FHA mortgage insurance.

- The final rule also includes expanded notification requirements for owners, buyers and developers.

Key points of interest for multifamily builders and developers:

- Compliance with the procedures for the FFRMS floodplain management and protection of wetlands is required for FHA-insured and HUD-assisted apartment properties no later than Jan. 1, 2025.

- For HUD-assisted, HUD-acquired and HUD-insured rental properties, new and renewal leases are required to include acknowledgements signed by residents indicating that they have been advised that the property is in a floodplain and flood insurance is available for their personal property, among other information.

- HUD assured borrowers that FHA multifamily mortgage insurance applications submitted Oct. 1, 2024, could be processed under the floodplain regulations that preceded HUD’s FFRMS requirements.

NAHB will continue to monitor this requirement and provide any updates on nahb.org.

Latest from NAHBNow

Mar 10, 2026

NAHB Announces 7 Fall Recruitment Competition WinnersFor their efforts, top Builder winners earned LG laundry machines, and Associate winners and all runners-up earned International Builders’ Show (IBS) VIP ticket packages, including registration to the show, IBS House Party tickets, opening ceremony seat reservations and VIP Closing Concert tickets.

Mar 09, 2026

Laura Dwyer Wins SA Walters Lifetime Achievement Award for Systems Built HousingThe NAHB Building Systems Councils has awarded the S.A. Walters Award for Lifetime Achievement in Systems Built Housing to Laura Dwyer, recognizing her decades of leadership, innovation, and service to the homebuilding industry.

Latest Economic News

Mar 10, 2026

AD&C Loan Volume Falls Despite Declining Financing CostsSingle-family construction lending fell in the fourth quarter, according to data released by the Federal Deposit Insurance Corporation (FDIC).

Mar 09, 2026

Lower Mortgage Rates Boost Refinancing While Purchase Activity SlowsMortgage application activity increased month-over-month as the 30-year fixed mortgage rates reached a three-year low.

Mar 06, 2026

U.S. Economy Loses 92,000 Jobs in FebruaryThe U.S. labor market weakened in February, as payroll employment declined and the unemployment rate rose to 4.4%. The cooling labor market could place the Federal Reserve in a challenging position as policymakers weigh slower job growth against inflation pressures from rising oil prices.